On July 29, Samsung Electronics announced its financial results for the second quarter of this year. According to the earnings report, Samsung Electronics’ second quarter revenue was 63.67 trillion won (about 357.25 billion yuan), the highest second quarter revenue ever; among them, Samsung’s semiconductor business second quarter revenue was 22.74 trillion won (about 127.726 billion yuan).

Samsung said that this significant increase in revenue is mainly due to the memory chip (DRAM and NAND) shipments and price increases exceeded expectations. Currently, Samsung is the world’s largest memory chip maker and consequently caught up with Intel to become the world’s largest chip maker in the second quarter.

On July 27, SK Hynix released its second-quarter earnings report, reporting revenue of 10.322 trillion won (57.92 billion won) and net profit of 1.988 trillion won (11.15 billion won), with a net profit margin of 19%.

recovered, which led to the improved performance. This is a good performance again after a three-year gap following the third quarter of 2018. It is also expected that demand will also continue to increase in the second half of this year and that the positive trend in the memory market will continue as we enter the peak season.

On July 1, Micron Technology reported revenue of $7.422 billion ($47.95 billion) and gross profit of $3.126 billion ($20.2 billion) for its fiscal third quarter ended June 3, with a gross margin of 42.1 percent. Micron Technology President and CEO Sanjay Mehrotra said DRAM and NAND price increases and customer demand are driving revenue growth. DRAM and NAND supply will remain tight through 2022 as the global economy recovers.

While the new crown pneumonia outbreak remains a risk factor, 2021 is shaping up to be a strong growth year for semiconductor companies, driven by macroeconomic recovery and long-term drivers such as AI and 5G. This shows that the memory chip market is gradually picking up after the price volatility of the previous year and is back on the fast track of growth.

Monopoly is one of the reasons for the high price volatility of memory chips

In 2019, memory chip prices have seen continued volatility due to the global wave of core shortages, the new crown pneumonia epidemic and seasonal demand, which has hit major memory chip manufacturers. According to the World Semiconductor Trade Statistics (WSTS), the global market for memory chips in 2019 is $106.4 billion, a decrease of $51.6 billion compared to 2018, while it rebounded to $117.5 billion in 2020, an increase of $11.1 billion, showing a steady upward momentum.

Meanwhile, WSTS expects the global semiconductor output value to reach US$527.2 billion in 2021, up 19.7% year-on-year; among which, memory output value will grow 31.7% year-on-year, ranking first; in 2022, the global semiconductor output value is expected to further reach US$573.4 billion, up 8.8% year-on-year; among which, memory output value will grow 17.4%, still ranking first in terms of growth. This indicates that memory chips have become the main driving force for the continued development of the global semiconductor industry, and have always maintained ultra-high growth.

For the price fluctuations of memory chips, Saidi Consultant IC Industry Research Center researcher Yang Jungang said, memory chip product prices are cyclical, memory chip product prices are mainly related to market demand, product inventory, product updates and iterations have a certain relationship. Recently, the overall global chip shortage, although memory chips are general-purpose products, but also affected by the global shortage of chips, resulting in certain fluctuations in the price of memory chips.

The general manager of Chuang Dao Investment Consulting, Bu Rixin, pointed out to “China Electronics News” reporter that the price of memory chips has always been a more obvious price fluctuations in the semiconductor field, mainly because the entire market pattern in a monopoly state, several giants can easily reach a tacit agreement on price increases.

It will take time for China’s memory chips to participate in global competition

China is the country with the highest demand for memory chips. According to the data of Sadie Consulting, the size of China’s memory market will be about 426.6 billion yuan in 2020, and according to the estimated global memory market size base (about 759.39 billion yuan) by WSTS in 2020, China’s market accounts for about 56% of the overall global size. It is expected that China’s memory chip market demand will continue to maintain a stable growth trend in the future.

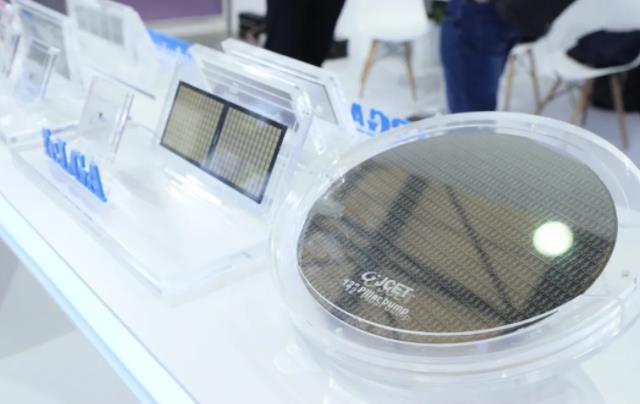

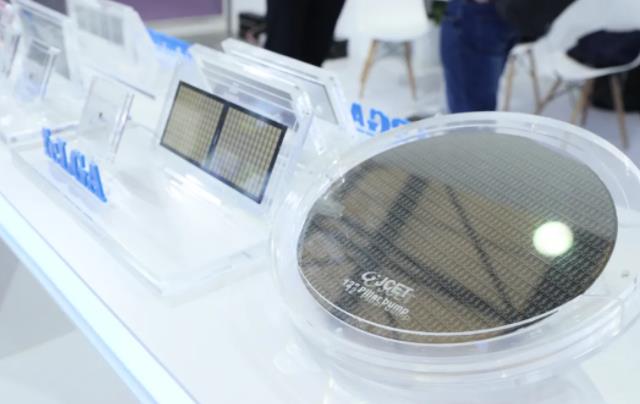

Yang Jungang pointed out that China has also made remarkable achievements in the field of memory chips. Hefei Changxin has mass-produced the first 19nm DDR4 memory chip in China; Changjiang Storage has completed the mass production of 64-layer 3D NAND Flash and completed the development of 128-layer 3D NAND Flash products, which have passed the customer verification stage; the market share of Zhaoyi Innovation Nor Flash has entered the top three globally; the market share of Juchen Semiconductor’s EEPROM has also entered the top three globally.

Li Guoyang, executive vice president of Lian Yun Technology, told China Electronics News, “At present, in the field of memory chips, China has achieved technological breakthroughs in DDR3/4 DRAM and 64/128-layer 3D NAND flash memory particles, and initially realized mass production and production capacity release, which is a zero breakthrough and landmark achievement for China in the field of memory chips. Based on the current technological breakthroughs and continuous release of production capacity, as well as the continuous improvement of yield and reliability, it is believed that after another five years of development, China will have the potential to truly become an important player and contributor to the global storage chip industry.”

However, there is still a large gap between China’s storage industry and foreign storage manufacturers. Yang Jungang explained that China is a new entrant, and there is a gap between the advanced global manufacturers in terms of technology level, R&D capability, product variety, product iteration speed, financial strength, intellectual property rights, and market share. At present, China’s technology level in the low-end storage chips has slowly come to the fore.

And step Rixin pointed out to the “China Electronics News” reporter, for the storage chip, our challenge exists not only in capital investment, technology research, but also in the establishment of the market ecology, the next step to open up the links of the entire industrial chain, so that domestic storage chips to find a place to use, and gradually use the local advantage, step by step to seize the market.

“The storage chip industry has high intellectual property barriers, with the characteristics of high technology threshold, and generally adopts the IDM model, which requires large capital investment to achieve a breakthrough.

Based on this industry characteristic, to effectively promote the development of storage chips, while relying on market-based means, there is a greater need for policy guidance to coordinate the promotion of domestic chip application scenarios landing, technology updates and iterations.”